Written by Thomas Schneck with DocuWare

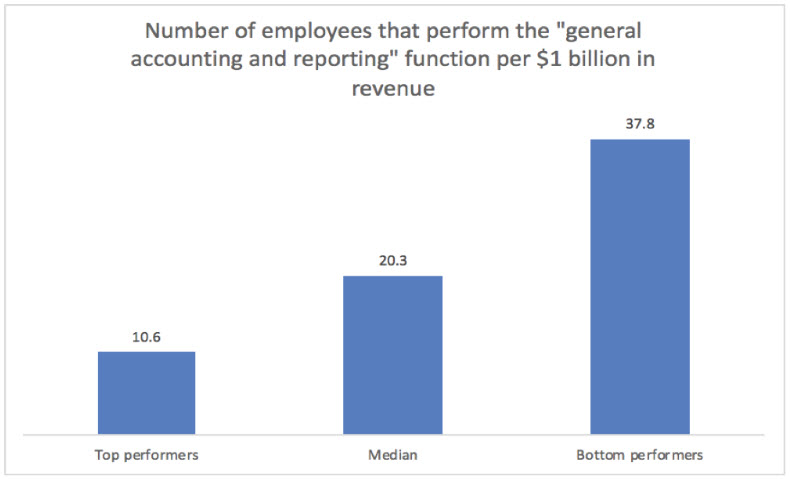

I recently listened to a fascinating webinar hosted by the American Productivity & Quality Center (APQC) on What’s Driving the 2018 Finance Agenda. Two particular finding attracted my attention. The first was a comparison of the number of full-time employees (FTEs) required to perform “general accounting and reporting functions.”

The comparison between top and bottom performing organizations is stunning; it doesn’t take a lot of analysis to conclude that bottom performers operate at a HUGE competitive disadvantage.

Source: APQC, What’s Driving the 2018 Finance Agenda

The second finding was a review of the priority 2018 activities for finance executives. Here are the top three – basically a priority list for CFOs aspiring to be top performers:

- Implement new technologies and capabilities

- Identify and implement best practices

- Standardize processes

Invoicing and payments are a key component – perhaps the key component – in determining financial efficiency and effectiveness. So let’s take a look at the three top 2018 priorities for finance executives identified by APQC that are key to being a top performing organization, and think about the top ten questions CFOs should ask about their invoicing process if they are going to be if they are going to be successful in achieving these priorities.

Implement new technologies and capabilities.

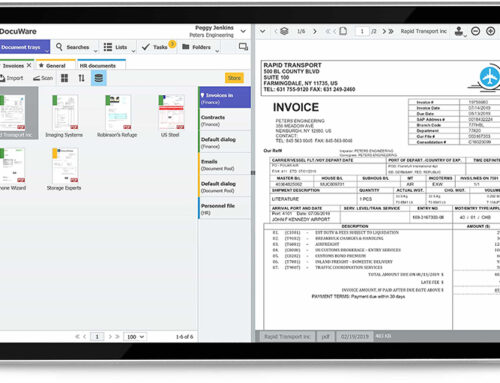

- Can you capture, sort and archive invoices from any device or any format (scanned paper, email, mobile capture, business apps and more)? Many companies still primarily receive invoices via unstructured formats like paper and email, and automting these manual processes – even if they are just exceptions – must be addressed.

- Can you easily find invoices –not just search for them, but actually find them? Huge productivity benefits can be gained by providing all offices with access to a centralized document pool and by directly incorporating field generated documents into office workflows. Think about the difference it could make if each person had the information they need to proficiently do their job – without waiting in a queue at a physical file room or searching shared and personal drives for documents.

- Can you extract key details from the invoices, including split code billing, and automatically match them to corresponding purchase orders?This means monitoring the accounts payable email, extracting relevant index terms, such as vendor name, date, and amount, indexing the invoice, and applying artificial intelligence to all of the above so that the system learns over time.

- Can your staff review and approve invoices on any mobile device? Anywhere?Self-service access to information positively impacts everyone in the company.

Identify and implement best practices.

- Do you have a secure, organized and searchable invoice archive and audit trail for audits and budget planning? One of the most stressful times for any accounting department is the wasted effort associated with responding to auditor document requests – pulling paper documents, copying them, and refiling the originals.

- Do you process invoices promptly, take advantage of early payment discounts, keep track of due dates and status changes, and have control over your cash flow management?Automation of the invoicing and payable process does not just savemoney; it earnsmoney by allowing the company to take advantage of discounts. Organizations with manual invoicing processes usually lack the core information they need to effectively run the business – how many orders are waiting to be processed, where they are in the process, and the value of each order.

Standardize processes.

- Have you standardized the core workflows that are needed to accelerate the approval process? Organizations typically do not realize how much wasted time and effort – and money – is tied up in simply waiting for a manual process to move from one manual stage to another.

- Is the supplier on-boarding process still a manual nightmare? This is a source of a great deal of inefficiency, especially for larger organizations and those with a large number of field offices.

- Can you route invoice approval requests based on amounts, vendor name or split code billing with multi-levels? Automatic electronic workflows give an organization the flexibility to keep work moving forward even when someone is away from the office.

- Can you automatically post approved invoices to your accounting or ERP system, eliminating double entry and errors?According to a recent study by Paystream Advisors, more than half (55 percent) of organizations still manually enter data into their ERP or accounting system.

Once you begin the process of invoice automation and seek a solution, remember these additional questions as you talk to vendors.

- Can their solution be deployed via the cloud or on-premises – without sacrificing functionality?

- How quickly can their solution be deployed?

- Can the solution provider give you a reference list of customers from within your industry?

- Can you buy the solution “by the drink” – via a subscription model – or is a big upfront investment required?

- Can the solution be easily extended to other processes outside of finance, or is it just a point solution?

While financial process initiatives may start with the intent of reducing costs, the longer-term organizational impact provides an opportunity to redefine the role of the CFO. Looking forward, the CFO will continue to be the primary financial steward of the organization. But the CFO also has a larger role to play, leading the charge for broader process transformation, and ultimately transformation of the business itself.